ACH vs Wire: The Complete Guide for Travel Businesses

Article

Tired of spending hours reconciling traveler payments, tracking down missing deposits, or paying more than you need to in processing fees? For many travel organizers, these challenges don’t just create extra work. They interrupt cash flow, reduce margins, and take focus away from delivering great experiences.

That’s why understanding how different bank transfer methods work–especially ACH and wire transfers, which many travel businesses rely on–matters. The payment method you choose determines how fast you get paid, what it costs, and how reliably funds reach your partners. Making informed choices here strengthens both your operations and your bottom line.

This guide breaks down how ACH and wire transfers work, when to use each, and how all-in-one travel payment processing platforms combine both methods to support scalable, global operations.

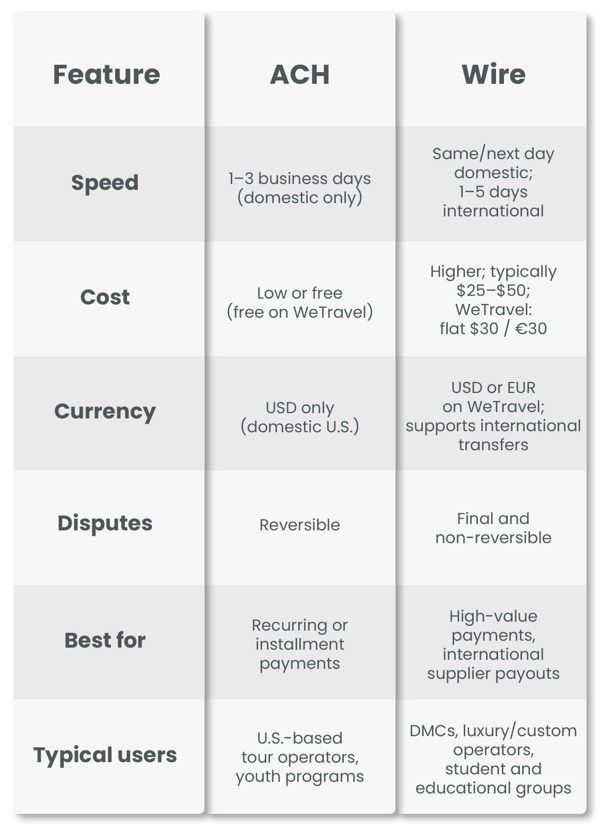

ACH vs. Wire Transfer: Key Differences for Travel Operators

What Is an ACH Transfer?

An ACH transfer (Automated Clearing House) moves funds between U.S. bank accounts through a centralized network. It is a preferred method for travel installment payment solutions because it's cost-effective, secure, and easy to automate.

How ACH Works

ACH payments are processed in batches rather than individually. This keeps fees low but adds a short processing window.

- Processing time: 1–3 business days

- Cost: Low or free; ACH is free on WeTravel

- Availability: Domestic USD transfers only

Common Travel Use Cases

- Scheduled traveler installments

- Group payments that don’t require same-day settlement

- Automated deposit collection tied to booking milestones

- Frequent, low-value payments that benefit from automation

ACH helps reduce administrative work, streamline reconciliation, and keep payment processing affordable. For U.S.-based group travel businesses, it is often the most efficient method for recurring payments.

What Is a Wire Transfer?

A wire transfer moves money directly from one bank to another, both domestically and internationally. Because wires settle individually–and are final once sent–they’re ideal for high-value or time-sensitive travel transactions.

How Wire Transfers Work

Wire transfers are push payments. The payer instructs their bank to send funds directly to the recipient. Once complete, wires cannot be reversed.

- Speed: Same/next day domestic; 1–5 business days international

- Cost: $25–$50 average; WeTravel wires cost a flat $30 / €30

- Ideal for: International suppliers, large group payments, final trip balances, custom and luxury operators

Common Travel Use Cases

- Paying DMCs, hotels, and transportation partners

- Collecting high-value payments from a single payer (schools, companies)

- Confirming final trip balances requiring fast settlement

- Custom and luxury itineraries, where travelers often pay large sums in a single transfer and both parties expect fast, final settlement

Because wires are non-reversible, they offer a level of security and certainty preferred for supplier payouts and high-value bookings.

Push vs. Pull Payments: Why It Matters in Travel

The core difference between ACH and wire transfers is who initiates the movement of funds.

Wire Transfers Are Push Payments

The payer pushes funds to the recipient. The transaction is final.

ACH Transfers Are Pull Payments

The recipient–such as a tour operator–pulls funds from the payer with authorization. Payments can be automated or scheduled, but disputes are possible.

How Should Tour Operators Use Them

- Use ACH for predictable schedules and recurring payments.

- Use wire when you need an immediate, undisputed settlement.

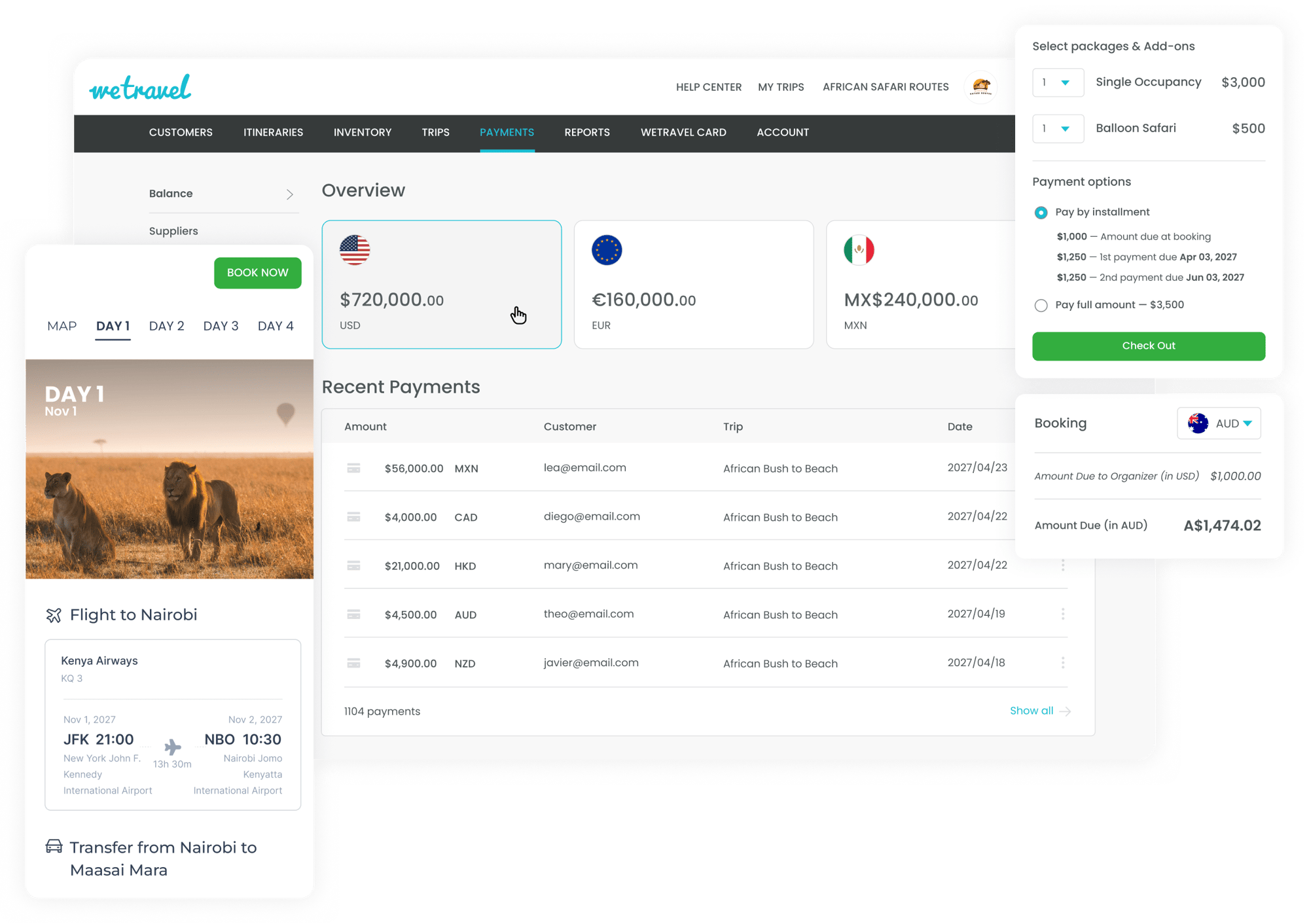

How All-In-One Travel Payment Platforms Unify ACH and Wire Transfers

Travel businesses no longer need to cobble together ACH, wire, card, and international payments across multiple systems. Today’s group travel payment systems unify collection, reconciliation, and payout workflows.

An end-to-end travel payment platform allows operators to:

Offer flexible payment methods

ACH, wire, credit card, mobile wallet, or local payment options — based on traveler preference and geography.

Consolidate booking and payout management

Every transaction is tied to a booking, trip, and participant for clean, automatic reconciliation.

Operate globally

Multi-currency support simplifies working with international travelers and partners.

Improve financial visibility

Automated reporting gives real-time insight into cash flow, revenue, and outstanding balances.

Reduce admin

No more manual matching of payments to bookings or managing payouts in separate banking tools.

How WeTravel Supports ACH and Wire Transfers

WeTravel’s operating system for multi-day travel centralizes booking and payout management for tour operators, with built-in payment tools designed specifically for the industry.

With WeTravel, operators can:

- Accept both ACH and wire transfers – free ACH and flat $30 / €30 wire fee

- Connect every transaction to a booking and participant automatically

- Automate reconciliation and reporting

- Support traveler payment plans, deposits, and flexible schedules

- Pay partners directly through the platform, instantly and for free

WeTravel brings speed, transparency, and flexibility to all payment workflows, helping travel businesses reduce overhead and improve the traveler experience.

The Bottom Line

Both ACH and wire transfers are essential for travel businesses, but each serves a different purpose:

- ACH transfers are cost-effective, automated, and ideal for domestic or recurring payments.

- Wire transfers offer finality, speed, and global reach, ideal for suppliers and high-value bookings.

The most efficient approach is to use a travel payment platform that supports both methods while tying payments directly to bookings, travelers, and supplier workflows.

WeTravel helps you accept the payment methods your travelers need, and manage every transaction from booking to payout – all in one place.

See How Smarter Payment Options Can Help You Scale

WeTravel brings ACH, wire transfers, cards, and international payment methods together in one platform, helping you reduce fees, speed up cash flow, and simplify payouts to partners and suppliers.

Book a demo to see how WeTravel’s payment tools support faster growth and more efficient operations.

FAQ

What is the difference between ACH and wire transfer for travel payments?

ACH transfers are domestic, low-cost bank transfers processed in batches, often used for traveler installments or recurring payments. Wire transfers are individual, final transactions ideal for international payments or high-value bookings requiring fast settlement.

When should I use ACH instead of a wire transfer?

Use ACH for scheduled or recurring traveler payments, deposits, or smaller domestic USD transfers where speed is less critical and cost efficiency matters.

Does WeTravel support both ACH and wire payments?

Yes. WeTravel supports free ACH transfers and low, flat-fee wire transfers ($30 / €30) for both domestic and international transactions.

Are ACH payments reversible?

Yes. ACH payments can be disputed or reversed in certain cases, which is why they are typically used for installments rather than final high-value payments.

What are the fees for wire transfers on WeTravel?

WeTravel charges a flat $30 / €30 per wire transfer, with no variable pricing or surprise fees.