WETRAVEL CARDS

Pay partners and cover business expenses, instantly

Your funds, as soon as you receive a payment, with no transfer delays

WeTravel Visa® Commercial Credit Cards are powered by Stripe and issued by Celtic Bank.

Money in, money out – on your terms

Accept traveler payments in multiple currencies at competitive rates

Deposits go straight into your WeTravel Wallet, ready to transfer

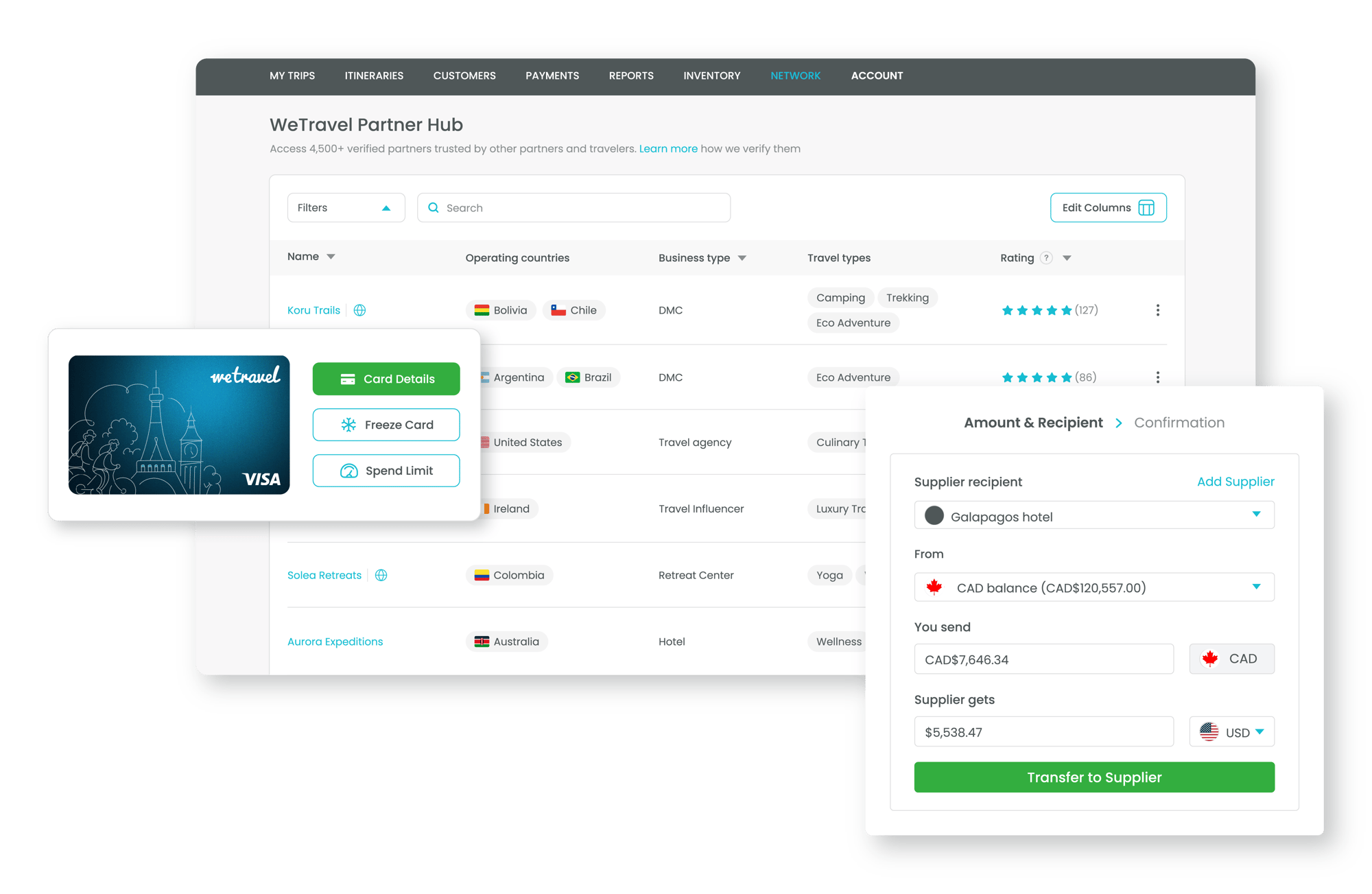

Create virtual Cards to send to your partners or add to an Apple Wallet. Set limits, track transactions and freeze when needed

With WeTravel

With WeTravel

- Get paid and make payments, instantly. Accept traveler payments and send funds to partners with no delay, strengthening partner relationships

- Move money without extra fees. Transfer funds to U.S. accounts for free

- Run your business in one place. Manage bookings, payments and payouts in one integrated platform

Without WeTravel

Without WeTravel

- Wire transfers can take up to five business days, potentially causing delays that could put strain on partner relationships

- Pay partners through multiple systems with different transaction fees, creating friction and potentially unforeseen costs

- Juggle separate tools for payments, bookings, and payouts, slowing down and fragmenting your operations

Instant access, no delays

Manage your expenses, your way

Empower your team, and stay in control

Equip your team with WeTravel Cards for on-the-ground expenses across key destinations, with real-time oversight and customizable spending limits.

One network, limitless growth

Connect with trusted partners, move money instantly, and reduce the busywork with WeTravel Network.

What fees are associated with using the WeTravel Card?

How quickly can I access funds on my WeTravel Card?

Can I create multiple WeTravel Cards?

What can I use the WeTravel Card for?

Am I eligible for a WeTravel Card?

What should I do if my WeTravel Card is lost or stolen?

How do I handle disputes or charge errors with my WeTravel Card?

Can I use my WeTravel Card internationally?

WEBINAR

Pricing and Payment: What's Sustainability Got To Do With It?

In this webinar, we will cover these and other principles borrowed from human psychology that can help you make behavior-smart decisions about your pricing and payment options.